Hurricane Energy Won't Tie Lincoln Well to Aoka Mizu FPSO in 2020

UK North Sea focused Hurrican Energy saw its share price drop on Thursday morning after the company's scrapped plans to tie-back the Lincoln Crestal offshore well to the Aoka Mizu FPSO this summer.

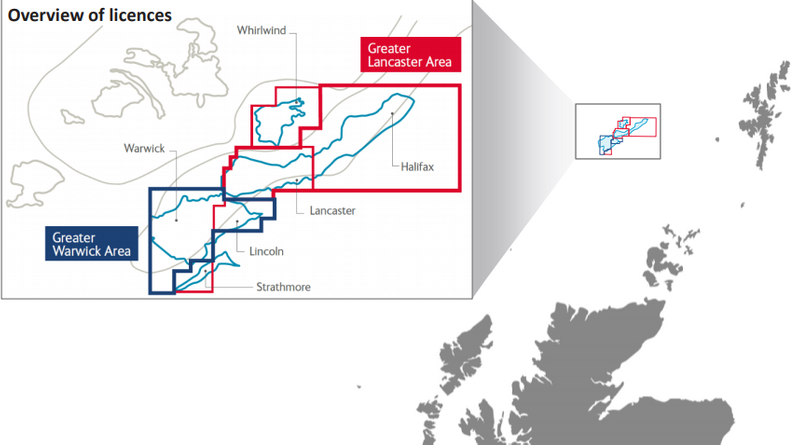

The company had drilled the Lincoln Crestal Well in the Greater Warwick Area (GWA) West of Shetland in the third quarter of last year, just months after starting production from its Lancaster field via the Aoka Mizu FPSO. The Lincoln well last year tested at a maximum stable flow rate of 9,800 stb/d and plans were made to tie it back to the FPSO.

However, Hurricane said Thursday that it won't possible to tie-back the Lincoln Crestal Well to the Aoka Mizu FPSO in 2020. The company, with its partner Spirit Energy, has also decided to release the installation vessels contracted to carry out the tie-back.

"The GWA Partners have agreed to continue to build all the previously ordered equipment," Hurricane said

Namely, according to Hurricane, the company had received regulatory consent for suspension of the Lincoln Crestal well, with gauges downhole, for the purposes of completing pressure build-up tests and gathering interference data. The suspension consent required that the well be plugged and abandoned by 22 June 2020.

Caption: Hurricane Energy Licenses - Image source: Hurricane Energy

Hurricane and Spirit plan to as for regulatory consent from the Oil and Gas Authority to delay the abandonment of the Lincoln Crestal Well in order to obtain interference data during well testing in 2020.

One or more sub-vertical wells are planned to be drilled and tested in 2020, to determine the maximum vertical extent of the Lincoln field in order to meet the commitment well requirement of the P1368 license extension ("Lincoln Commitment Well").

"If the GWA Partners are unable to obtain approval to extend the suspension consent, the Lincoln Crestal Well will be plugged and abandoned by the Paul B Loyd Jr rig in March 2020, prior to the planned start of the Lincoln Commitment Well," Hurricane said.

"The GWA Partners are reviewing the future work program and budget for the Greater Warwick Area. Further updates will be provided on the conclusion of these discussions with Spirit Energy," Hurricane Energy said.

Focus on Lancaster

Hurricane said it still planned to make maximum use of the Aoka Mizu FPSO's oil throughput capacity.

"As part of this strategy, Hurricane is planning an accelerated Lancaster work program, focussed on drilling an additional production well on Lancaster in 2020, in addition to the drilling of one or more subvertical wells (in 2021) to determine the maximum extent of the Lancaster field, to satisfy the terms of the P1368 license extension (the "Lancaster Commitment Well")"

Hurricane is in talks over a rig contract to drill and test production well on the Lancaster license ("Lancaster -8 Well") during Q2 / Q3 2020.

On success, and subject to regulatory consents, the company would intend to tie-back the Lancaster -8 Well to the Aoka Mizu FPSO in 2021, with a provisional first oil date in Q1 2022.

"Commitment to capital expenditure in respect of the installation of the tie-back will not be made until after the Lancaster -8 Well has been successfully tested. Increased production through the Aoka Mizu FPSO would improve unit economics and generate increased operating cash flow for providing returns to shareholders and/or funding future phases of development," Hurricane said.

Hurricane Energy's share price fell to 17.58 pence on Thursday, from a previous close of 21.10 pence.

In a recent operational update, Hurricane said that the Lancaster field had produced 15,400 barrels of oil per day in the third quarter of 2019 - significantly above guidance of 9,000 barrels of oil per day on good facilities availability.

Also, the field in the fourth quarter produced 11,800 barrels of oil per day - exceeding updated guidance of 11,000 barrels of oil per day despite ongoing commissioning activities and the start of individual well tests.

The company had previously said that the Q4 decline vs Q3 had been expected due to a number of outstanding facilities-related issues.